GUD Half Year Results Show Steady EBITDA Multiple

- Mike Williams

- Feb 8, 2019

- 2 min read

GUD recently announced it's first half results for FY19, which has been reported by Market Matters, with the stock punished by 9% immediately after the announcement. Since then the share price has climbed back to around $12, but still down from its pre-announcement highs of $12.50.

Market Matters has reported that the second half results need to perform well in order to meet full year expectations. In essence the market has factored in a lower than expected full year earnings result and the share price has fallen as a result.

But what does this mean for the risk profile of the business and its underlying Enterprise Value:EBITDA multiple?

A quick analysis shows GUD had an EV:EBITDA multiple of 12.3x at the end of FY18, and this has now reduced to 12.0x:

The business is somewhat of a traditional manufacturer and distributor of automotive parts (including OEMs and after-market parts) and water pumps and water products.

This analysis suggests the risk profile of the business has increased marginally (2.5%), but not significantly changed. That fits our perception of the current climate - overall risk is similar to 6 months ago, but with little likelihood of earnings growth. In reality this means valuations are sliding backwards as the same earnings in six months time will be worth less than the earnings now (time value of money).

So what does this mean for the expected EV:EBITDA multiples of the average SME?

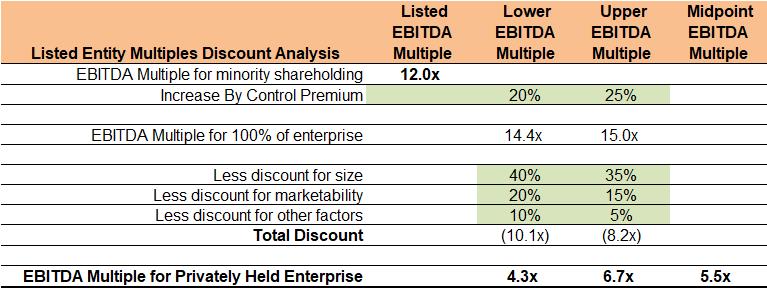

The chart below shows the typical discounts we would apply to the listed EV:EBITDA multiple in order to arrive at multiples for smaller companies in similar industries:

We view these as upper-limits to multiples applied to SMEs, with multiples greater than 4.0x reserved for manufacturing SMEs with revenue in excess of $20m, high profit margins and well established structures and systems.

In theory we would expect this upper-limit to decrease same extent as the GUD multiple. However we like to compare SMEs to a basket of stocks, and our assessment of multiples for SMEs is not as accurate as a 2.5% decrease.

If, however, we see more manufacturing stocks announce reduced or static earnings that lead to a reduction in EV:EBITDA multiples, then our valuations would need to be reduced.

If you want to learn more about the valuation of your business then contact us for an obligation free discussion.

Comments